No changes were made to the existing positions.

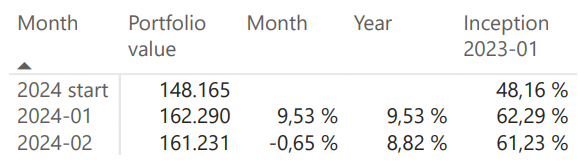

February saw our portfolio decrease by -0.65%, bringing our performance to 8.82% year-to-date and 62.23% since we began in January 2023.

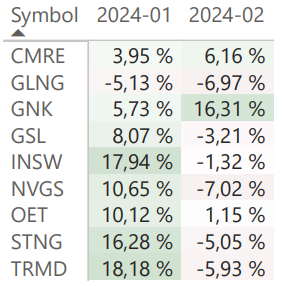

Despite the overall downturn in shipping, our portfolio found a lifeline in GNK and CMRE, showcasing the vital importance of diversification across different shipping sectors. As I mentioned last month, we were overweight in tankers, but in hindsight, the dry bulk sector proved much more attractive.

Unfortunately, STNG did not meet my expectations, largely due to what I perceive as subpar governance. This disappointment emphasizes the need for continuous scrutiny of management practices within many shipping companies.

On a brighter note, shipping valuations remain attractive, offering potential opportunities for astute investors. However, we must tread carefully as the geopolitical situation, notably the ceasefire rumors and developments in the Red Sea, could introduce further volatility into shipping stocks.

In light of these challenges and opportunities, I am contemplating some strategic adjustments to the model portfolio. Although I’m considering swapping STNG for HAFNI, for now, I’ve decided to maintain the current positions. Additionally, I’m exploring the possibility of adding a new position to the model portfolio, which warrants further research over the coming month.

Despite the setbacks experienced this month, my outlook on the shipping sector, especially tankers, remains predominantly bullish. Stay tuned for next month’s update!

Positions for March 2024

- CMRE

- GLNG

- GNK

- GSL

- INSW

- NVGS

- OET

- STNG

- TRMD

Portfolio Performance Tracking

This website contains no investment advice and is purely for informational and educational purpose. Do your own research! For more information please also check the model portfolio page.