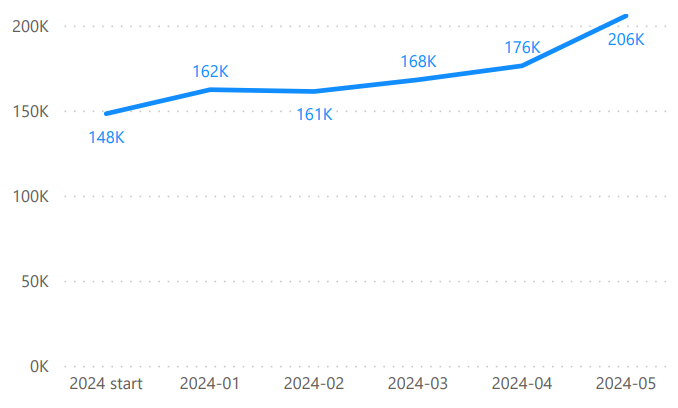

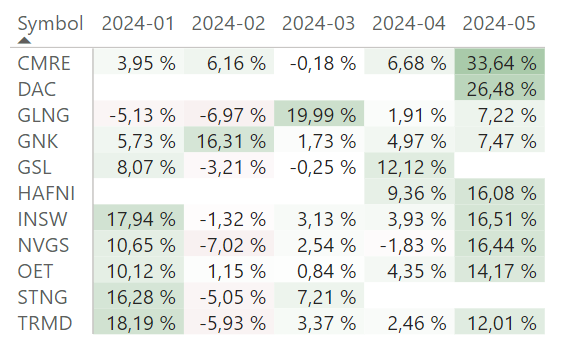

In May, our portfolio achieved great results with a monthly gain of 16.67%, bringing our year-to-date increase to 38.84% and our overall growth since inception in 2023 to 105.76%.

Container stocks were particularly noteworthy this month, experiencing significant run-ups. With congestion at crucial locations like Singapore and rising spot rates, we will to continue monitoring these trends closely.

The outlook for tanker stocks remains very favorable, although valuations are becoming steep. Our strategy of retaining stocks managed by excellent teams is proving costly but remains fundamental to our investment philosophy, thanks to their proven resilience and performance.

A key event was Oaktree’s divestment of 6.9 million TRMD shares. The market reacted less negatively than expected, which I view as bullish for tankers. This development supports our strategy of monthly portfolio rebalancing and minimal trading.

Given that shipping stocks are not as attractively priced as they were earlier in the year, I decided to diversify our exposure. This month, we introduced a significant new position in cash/bonds through BIL, assigning it a 3x weight, which represents 25% of our entire model portfolio. This strategic adjustment aims to hedge against potential volatility and capitalize on market adjustments.

While shipping still offers value compared to other sectors and the broader market, relying on increases in valuation multiples right now seems risky. However, there remains potential for an increase in NAV to bring P/NAV to more appealing levels, even without a correction. Many companies continue to pay attractive dividends, and the balance sheets of our holdings, as well as the industry at large, remain robust.

Positions for June 2024

- BIL (3x)

- CMRE

- DAC

- GLNG

- GNK

- HAFNI

- INSW

- NVGS

- OET

- TRMD

Added positions

BIL (3x)

For the first time since inception, we have added cash/bonds to our portfolio. I chose the SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) as the instrument for this addition. Despite the current inverted yield curve, we are avoiding speculation on a normalization of these conditions. Instead, our focus remains on maximizing the performance of our shipping stocks.

Portfolio Performance Tracking

This website contains no investment advice and is purely for informational and educational purpose. Do your own research! For more information please also check the model portfolio page.