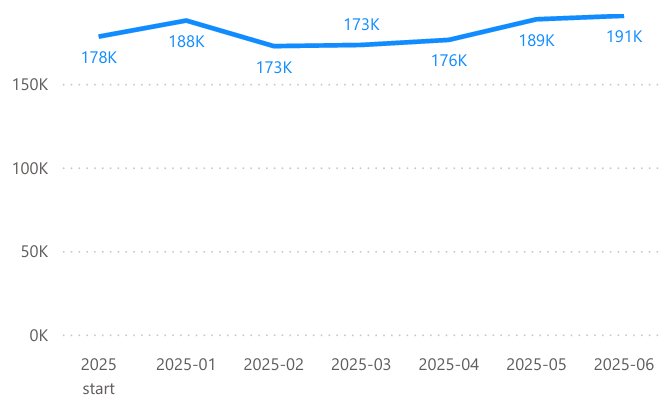

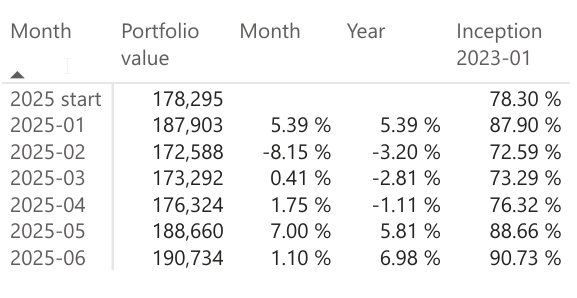

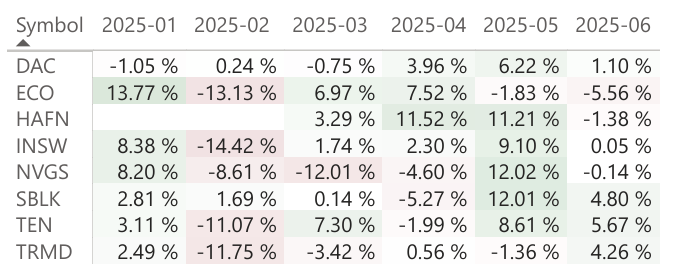

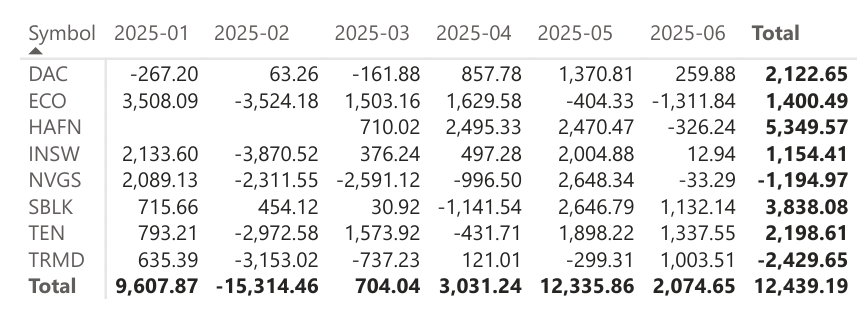

There was no update last month due to a vacation, but the portfolio held up well in my absence. May delivered a strong +7.00%, and June added a modest +1.10%, bringing our year-to-date performance to +6.98% and total returns since inception in January 2023 to 90.73%.

We’re making one change this month and are swapping out TRMD for GLNG. Tankers remain a core holding, but with our exposure already high, we’re using this as an opportunity to diversify.

Shipping valuations remain compelling, but the overall market looks increasingly expensive. While we stay fully invested in the model portfolio, there’s no shame in holding up to 20% cash or bonds if you want to reduce risk.

Positions for July 2025

- DAC

- ECO

- GLNG

- HAFN

- INSW

- NVGS

- SBLK

- TEN

Closed positions

TRMD

Still a great company, but I feel like we had too much tanker exposure for the current sentiment.

Added positions

GLNG

We are reopening this position to diversify. Great company with great cashflow.

Portfolio Performance Tracking