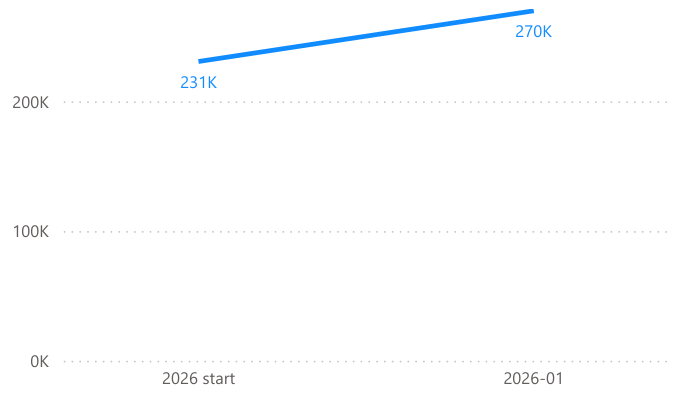

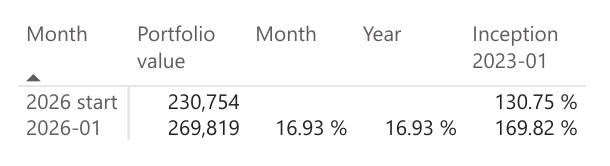

January was a very strong month for the portfolio after a difficult December. Performance for the month was +16.93%, which more than recovered the prior losses.

Since inception in January 2023, the portfolio is now up 169.82%. This puts the recent volatility into perspective and shows how quickly sentiment can change in this sector.

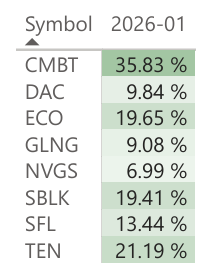

From a fundamental point of view, the setup still looks attractive. VLCC rates are on fire, while LNG took a dive. Tankers, especially VLCCs, continue to look very promising. Dry bulk also looks like a very interesting setup looking into 2026.

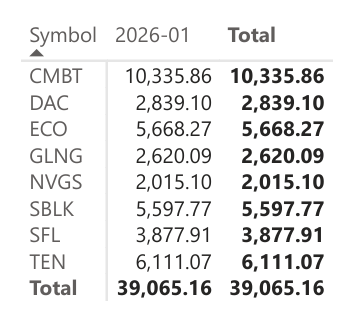

The best performing stock last month was CMBT after a strong run. I still like the company a lot, but after this move it made sense to reduce risk slightly. Instead of trimming the position directly, I decided to add short term bonds (BIL) with a 3x weight to the portfolio. This lowers overall risk while keeping the core exposure intact.

There are other positions I am questioning at the moment, but for now we want to stick to our limited trading approach and simply add the bonds. We will see how we can position ourselves next month with lower volatility.

After a weak December, January was a good reminder of why patience matters in shipping. Volatility is part of the process. As long as fundamentals remain intact, I am comfortable staying invested and letting the thesis play out.

Positions for February 2026

- 3 x BIL

- CMBT

- DAC

- ECO

- GLNG

- NVGS

- SBLK

- SFL

- TEN

Portfolio Performance Tracking