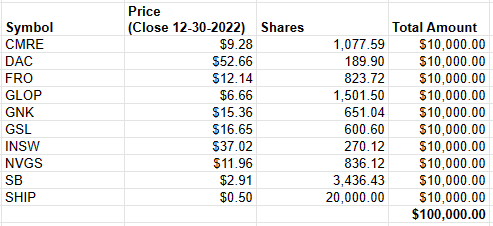

The model portfolio for January 2023 starts with a fictional amount of $100,000 and consists of the following stocks.

Costamare Inc (CMRE)

Great company to get container and dry bulk exposure. Good valuation and management with cash close to market cap. Trades at a discount to its historical valuation compared to its peers.

Danaos Corporation (DAC)

Very cheap containership company. DAC secured a multiyear contract backlog at very good conditions and hopefully will not suffer too much from the lower rates we see today. Not the shareholder friendliest company, but if the management plays fair there’s a lot of upside potential.

Frontline (FRO)

Relatively safe value play to get crude tanker exposure. Trades on historically low valuation compared to its peers. That’s probably because of a upcoming merger with EURN.

GasLog Partners LP (GLOP)

Cheap LNG pick with poor governance. The company only pays $0.01 per quarter as a dividend, but could easily pay sustainable $0.10. I hope this is because they’re building cash to take the company private or raise the dividend in the next months.

Genco Shipping & Trading Limited (GNK)

Cheap dry bulk exposure with good governance. Shareholder friendly and a great balance sheet. Basically a bet on dry bulk revovery.

Global Ship Lease Inc (GSL)

Very cheap containership company. Very similar to DAC with a long contract backlog to shield it from the falling container rates, but smaller and with a management that’s a lot more shareholder friendly.

International Seaways Inc (INSW)

Product and crude tanker exposure wihout the merger uncertainty of FRO. Solid management and good outlook.

Navigator Holdings Ltd (NVGS)

Solid value pick in the LPG sector. My models suggest limited upside, but a relatively safe bet in a promising sector.

Safe Bulkers Inc (SB)

Highly leveraged dry bulk play. Safe Bulkers could profit a lot if we see a dry bulk recovery in 2023 and has a decent fixed dividend.

Seanergy Maritime Holdings Corp (SHIP)

Cheap dry bulk that could benefit a lot if dry bulk rates recover. The fact that it’s a penny stock could give it a lot of leverage.

This website contains no investment advice and is purely for informational and educational purpose. Do your own research! For more information please also check the model portfolio page.