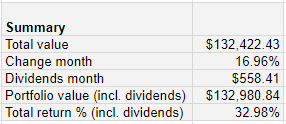

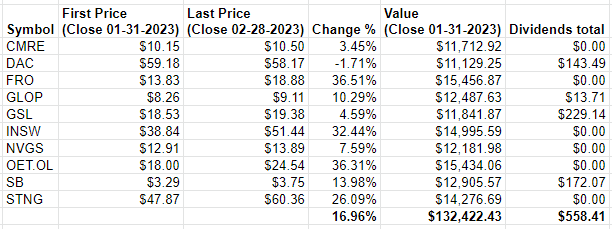

February proved to be a remarkable month for the model portfolio, as it delivered an impressive return of 16.96% plus $558.41 in dividends.

This brings the total return for the first two months to 32.98%, with an initial investment of $100,000 growing to $132,980.84.

The only negative position this month was DAC. My assumption is that this is due to subpar governance, missing shareholder returns, and negative sentiment surrounding the container sector. All other positions performed pretty well, especially tankers.

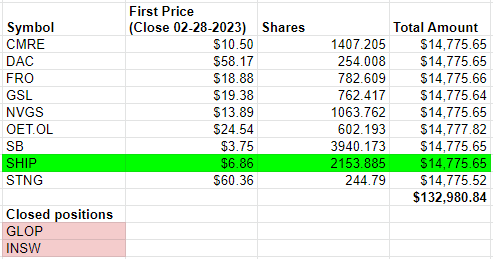

These are the positions for March 2023.

Please note that the portfolio this month only consists of nine positions, so remember to rebalance accordingly.

The whole portfolio including all dividends is rebalanced at equal weight every month.

Closed Positions

GasLog Partners (GLOP)

Following a rip-off offer, the stock trades at a premium. While I anticipate an improved offer in the near future, I still do not trust the management and prefer to close this position. The buyout thesis played out well, but not as well as I expected. You can stay invested to gamble for a higher offer in the next months, but I’d be surprised if we see more than $10 here.

International Seaways Inc. (INSW)

INSW had an impressive run, but I prefer other investment opportunities at current valuations.

Added Positions

Seanergy Maritime Holdings Corp (SHIP)

SHIP did pretty well in the last month and in hindsight it would have been better to not exclude the stock from the portfolio in February. The only updates here are the recent stock split and still very unfavorable dry bulk rates. The stock looks like a good, but risky opportunity. You can easily lose money here, but you also have a lot of upside potential.

Other remarks

Despite numerous developments in February, I still aim to limit trading as much as possible. Most positions are reasonably priced or even cheap. While tankers and dry bulk may be on the higher end of the price range compared to containers, I believe their value is justified. Tankers may still be at the start of a multi-year cycle, and dry bulk could benefit greatly if China reopens and stimulates its economy.

This website contains no investment advice and is purely for informational and educational purpose. Do your own research! For more information please also check the model portfolio page.