This month marks the first portfolio update since March.

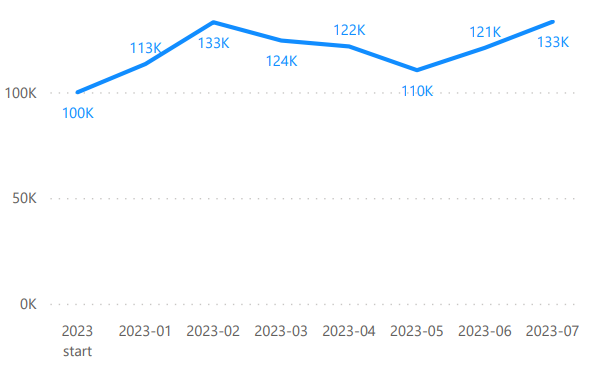

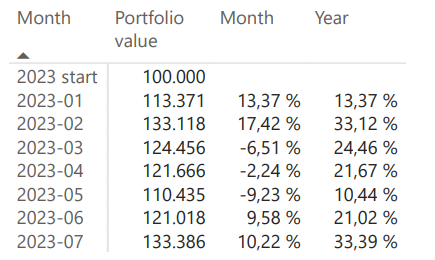

After a fantastic start to the year from March until May, the sector, and consequently the portfolio, performed poorly. However, June and July were good months, so I’m quite pleased with the overall performance for this year. The total return at the end of July stands at 33.39%.

I spent the last few months working on my custom software to track positions and perform backtests. Since there were no portfolio changes from April until July, I didn’t create any posts. However, I have now added them retroactively to maintain a clear history.

The new posts are in a revised format. I changed my Google Sheets template at the beginning of the year, but I don’t want to alter the old posts again. This means that the format and measurements are not completely consistent, but I don’t think that’s a problem. The main focus should be on picking undervalued stocks, while trying to reduce trading to a minimum.

With my old Google Sheets template, I tracked the portfolio using Yahoo Finance and the Google Finance API. From now on, I will utilize the Interactive Brokers API with historic ADJUSTED_LAST data. This means that adjustments for dividends, splits, and other factors will be handled by Interactive Brokers. Although I won’t be able to track dividends easily and consistently, the total performance should remain accurate, and that’s the primary aspect we’re monitoring.

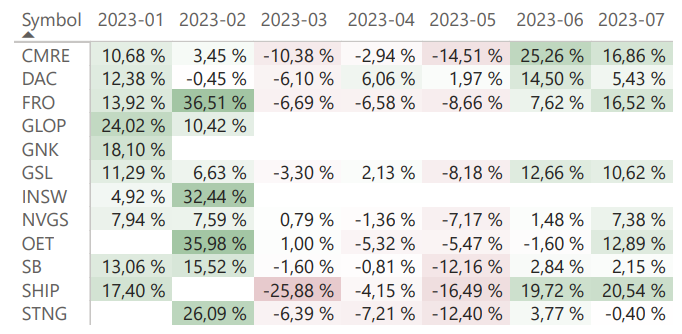

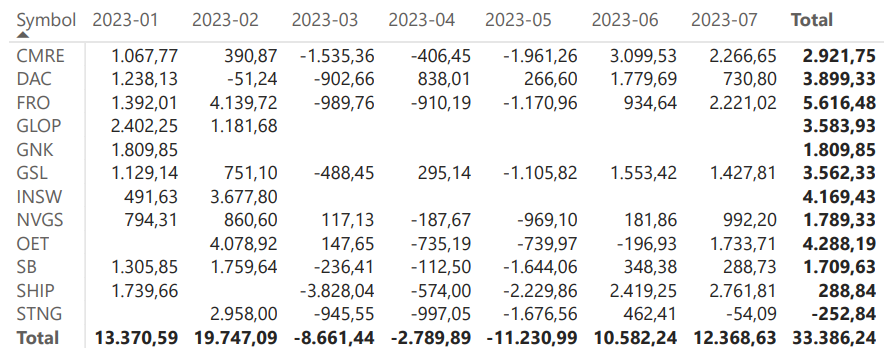

Since the charts and tables are taken from my personal software and aren’t in US formats, I’ll attempt to correct this in the future. Apologies for any inconvenience.

Positions for August 2023

- AGAS

- CMRE

- GLNG

- GSL

- GNK

- INSW

- NVGS

- OET

- STNG

After the recent run-up, we are altering some positions again.

Closed positions

- DAC

- FRO

- SB

- SHIP

DAC and FRO performed exceptionally well. There’s not much to add, other than that I believe there are alternatives with more attractive valuations. GSL is quite similar to DAC, and I feel we have enough container exposure with this pick, which we’ll retain in the portfolio. FRO enjoyed a great run-up, and we have ample tanker exposure with INSW, OET, and STNG.

Regarding SB and SHIP, I’m less optimistic about dry bulk than I was a few months ago. SHIP demonstrated once more that it’s a company with poor governance. Despite claiming they would maintain the dividend, they cut it by 90%. It’s a high-risk, high-reward stock, and I’m glad we can exit the position with a slight profit. We will continue to maintain some dry bulk exposure, as reflected in the added positions.

Added positions

- AGAS

- GLNG

- GNK

- NVGS

I’m bullish on gas tankers, and AGAS, GLNG, and NVGS offer exposure and diversification. I initially considered adding GASS, but I prefer our new positions following its recent run.

GNK is our replacement for SB and SHIP. At the moment, I prefer it from a value perspective, while we reduce our overall dry bulk exposure.

Portfolio Performance Tracking

This website contains no investment advice and is purely for informational and educational purpose. Do your own research! For more information please also check the model portfolio page.