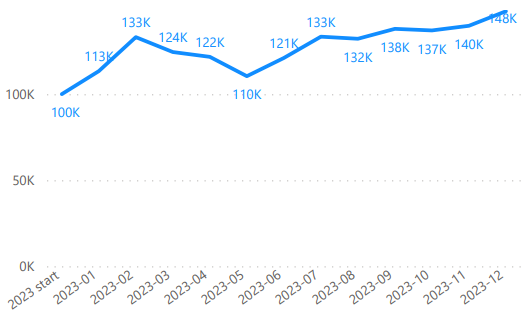

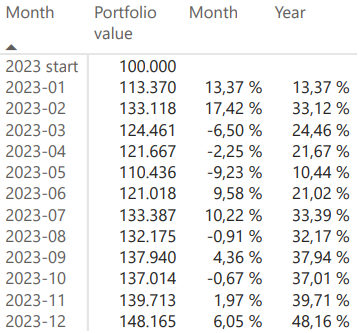

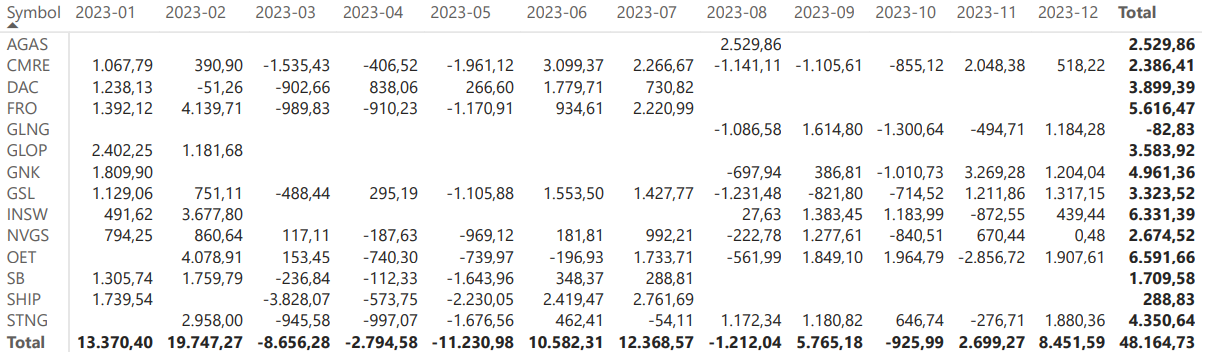

Happy New Year, everyone! It’s been a whole year since we started sharing our model portfolio with you all. And what a year it’s been! We finished it with a strong performance of 48.16%, which feels great, even if the overall market was doing well too.

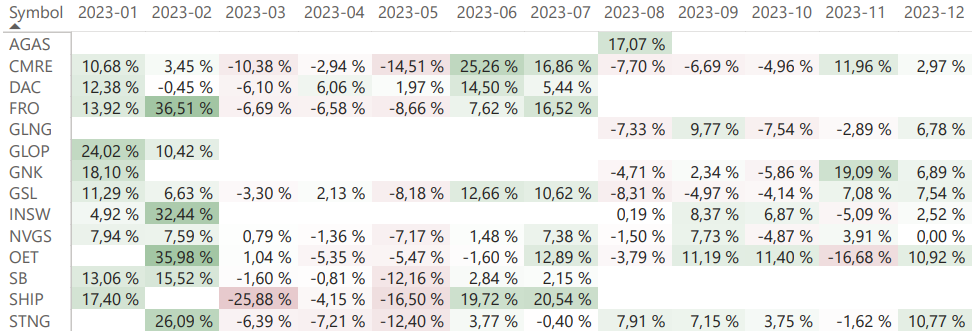

Let’s take a quick look at how our portfolio did. Most of our choices did really well, except for GLNG and SHIP, which remained relatively flat. There are some things I wish we’d done differently. We sold AGAS too early; they kept going up after we let them go. Also, keeping SHIP wasn’t the best idea because they didn’t stick to their promise about dividends, and that hurt our returns.

Investing can be tricky. Even with all our research and planning, things don’t always go as we expect. Take the dry bulk sector, for example – it didn’t do as well as we thought it would for most of the year.

Looking ahead to this year, we’re going to be even more careful about investing in companies with bad management. GLNG is an exception, though. They didn’t do great, but they might sell the company if their big projects don’t work out, so we’re keeping an eye on them.

The shipping markets at the end of the year were characterized by the tragic events in the Middle East. The high volatility will likely continue in 2024.

If you’re worried about the market being too volatile, I think it’s okay to keep some of your money in cash or maybe bonds. Right now, our portfolio is all in stocks, but I might reconsider this strategy if stock valuations become too high in the future.

Positions for January 2024

- CMRE

- GLNG

- GNK

- GSL

- INSW

- NVGS

- OET

- STNG

- TRMD

Added positions

- TRMD

I’m still happy with the positions of our portfolio and just want to add a little bit more tanker exposure with TRMD. I was going to replace STNG with TRMD, but decided to keep both in the portfolio to overweigh tankers, but still get some diversification, even if it’s highly correlated.

Portfolio Performance Tracking

This website contains no investment advice and is purely for informational and educational purpose. Do your own research! For more information please also check the model portfolio page.