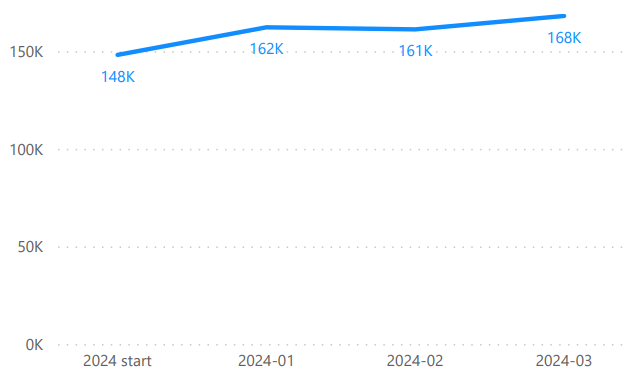

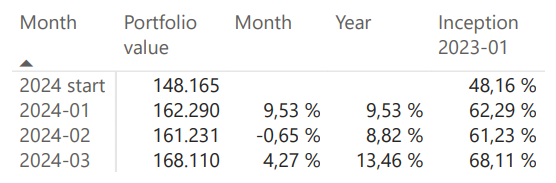

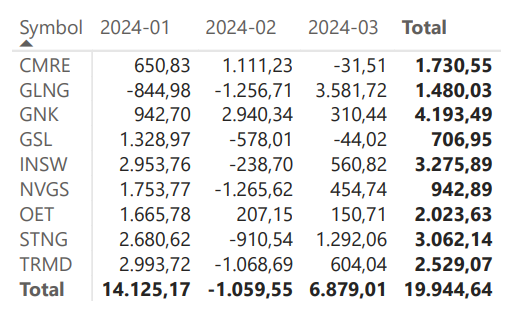

In March, our portfolio grew by 4.27%, bringing our gain for the year to 13.46% and our total gain since we started in January 2023 to 68.11%.

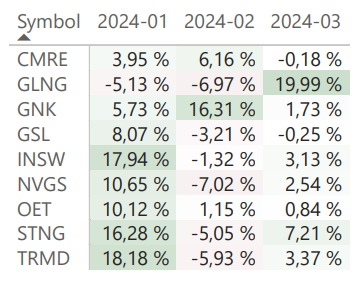

This month, GLNG was our best-performing stock, showing the value of not putting all our eggs in one basket and investing in different parts of the shipping industry. Even though GLNG did really well, I’m looking into whether we should trade this stock for CLCO. This idea is part of our ongoing effort to make sure our investments are as good as they can be, given the changing market conditions.

Looking back, delaying the swap of STNG for HAFNI was a smart move. STNG really picked up last month and did much better than expected, while HAFNI didn’t do as well. This difference highlights how important good management is, and now seems like the right time to go ahead with the swap, aligning our portfolio with a company that’s managed better.

Apart from this one change, we’re keeping our portfolio the same. This shows that I’m confident that our current stocks are still good opportunities.

Positions for April 2024

- CMRE

- GLNG

- GNK

- GSL

- HAFNI

- INSW

- NVGS

- OET

- TRMD

Closed positions

STNG

This stock is still priced low, but it feels too costly for me when I look at the management quality compared to other companies like HAFNI or TRMD. I’ve decided to let go of this investment.

Added positions

HAFNI

We’re choosing HAFNI as our new pick over STNG. While these companies aren’t identical, HAFNI is close enough to provide the tanker exposure we desire. Additionally, it offers us the chance to invest in a company with superior management. However, it’s important to note that HAFNI, being smaller, might face challenges in attracting institutional investment at the same level as larger companies like STNG. Despite this, I see significant value in its management quality and potential for strategic growth.

Portfolio Performance Tracking

This website contains no investment advice and is purely for informational and educational purpose. Do your own research! For more information please also check the model portfolio page.