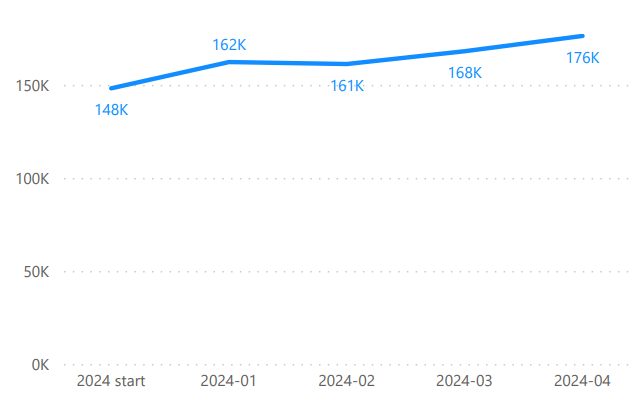

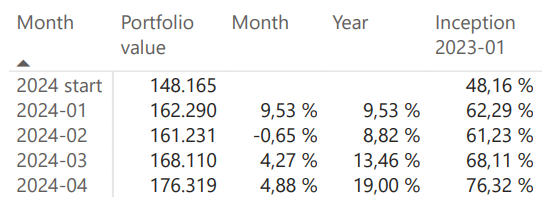

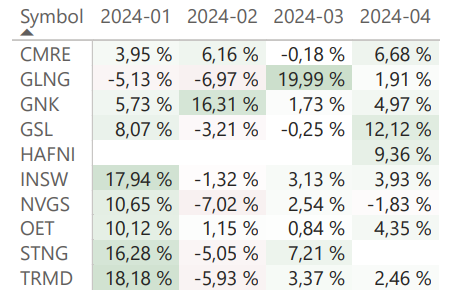

In April, our portfolio performed exceptionally well, achieving a growth of 4.88%, which pushed our year-to-date gains to 19.00% and our total increase since we started in January 2023 to 76.32%.

This month was particularly strong for shipping equities. GSL was our best-performing stock, rising by 12.12%. Due to this significant increase, I’ve decided to remove GSL from our portfolio to lock in these profits, especially as the overall market is becoming more expensive. Although our model portfolio currently holds no cash, the idea of maintaining a significant cash reserve is on the table if stock valuations become too high. Meanwhile, many of our remaining stocks are still paying attractive dividends, and those with less strong management continue to offer good value, keeping their place in our portfolio.

I’m tempted to increase our dry bulk exposure, but have decided against it for the moment.

Positions for May 2024

- CMRE

- DAC

- GLNG

- GNK

- HAFNI

- INSW

- NVGS

- OET

- TRMD

Closed positions

GSL

I still like GSL, but I think it got too expensive compared to our new position DAC. The yield is still nice and this was a tough decision.

Added positions

DAC

DAC is our replacement for GSL. Normally, I prefer GSL, but the outperformance was substantial, and I think at this price, DAC is more promising, despite the lower yield and management quality.

Portfolio Performance Tracking

This website contains no investment advice and is purely for informational and educational purpose. Do your own research! For more information please also check the model portfolio page.