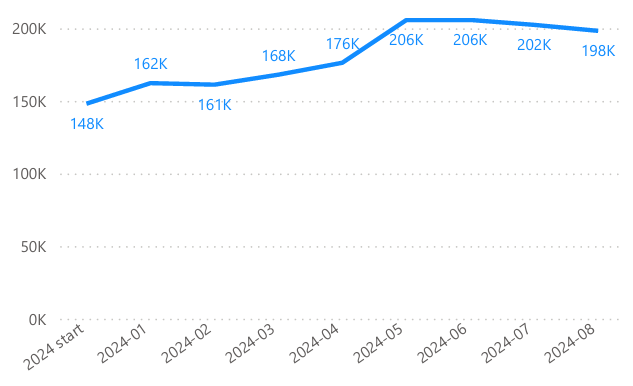

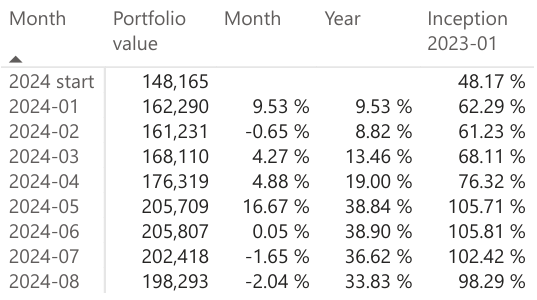

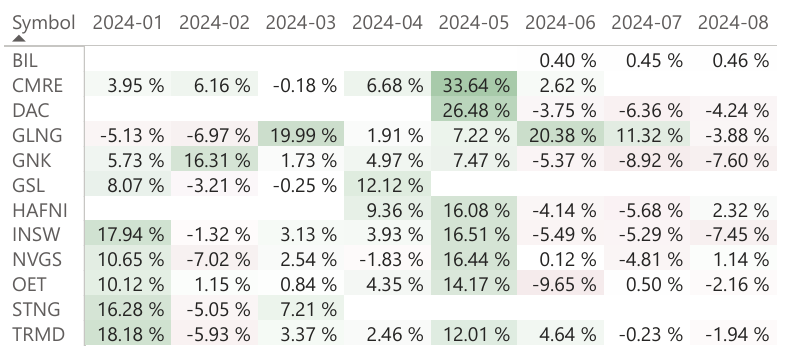

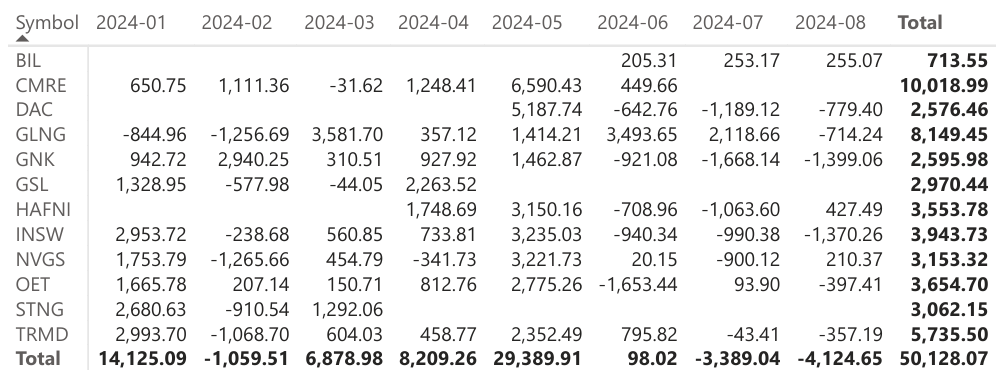

August wasn’t the best month for us, ending with an MTD decline of -2.04%. However, with some cash still on hand, valuations are beginning to look much more reasonable compared to a few months ago. On a positive note, we’re still up 33.83% YTD.

This month, I added ZIM as a new position. We’re currently holding more cash and a wider range of positions than I’d prefer, but I don’t intend to close any positions at this time. I’m still bullish on tankers and believe in maintaining some diversification.

Positions for September 2024

- BIL (3x)

- DAC

- GLNG

- GNK

- HAFNI

- INSW

- NVGS

- OET

- TRMD

- ZIM

Added positions

ZIM

As I mentioned last month, ZIM looks very attractive at its current levels. It had a strong start to the month, but experienced a significant sell-off toward the end. In my view, this stock should be trading between $25 and $30 at the moment. While it’s not a long-term holding due to the substantial container ship order book, I believe it’s an attractive short-term opportunity.

Portfolio Performance Tracking

This website contains no investment advice and is purely for informational and educational purpose. Do your own research! For more information please also check the model portfolio page.