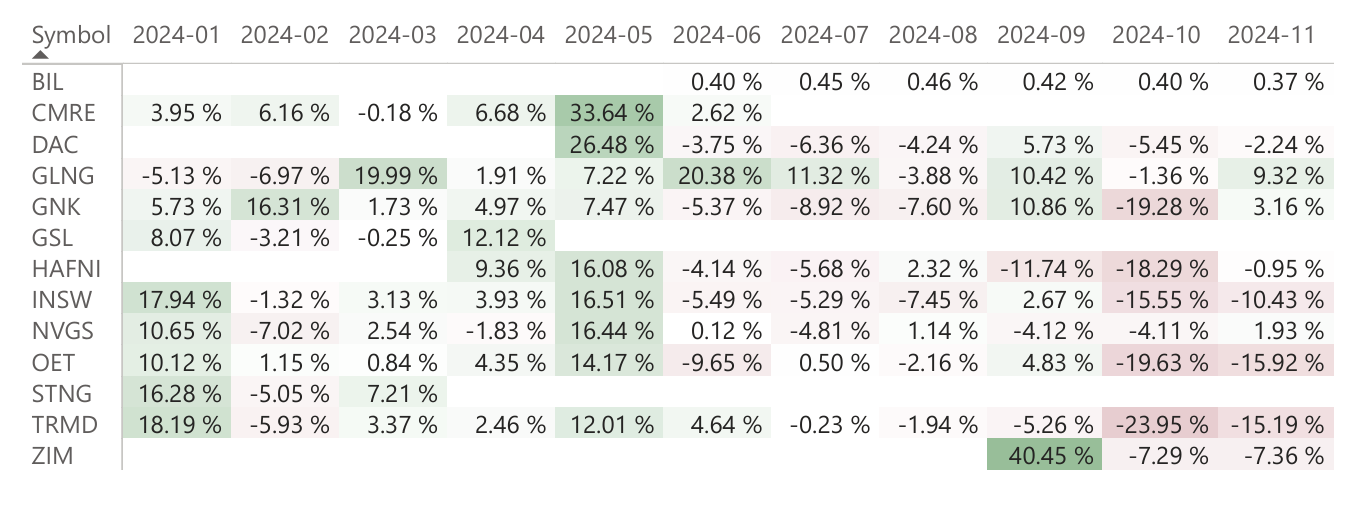

It’s been a while since the last portfolio update, as I was on vacation. Unfortunately, the market didn’t take a break, and the past two months have been particularly challenging for shipping stocks. Especially our tanker and dry bulk positions took significant hits, with the portfolio recording a -9.48% performance in October and -3.05% in November. This brings our year-to-date performance down to 22.84%. Still positive but far from the highs of earlier this year.

ZIM reached the upper end of our target price, trading slightly above $30 after its earnings release. However, the optimism didn’t last, and the stock took a hard fall afterward. This highlights one of the challenges with our monthly rebalancing approach. Sometimes, the timing works against us. Despite the drop, we’ve decided to hold ZIM for now, as the valuation remains attractive, and the stock still fits within our broader strategy.

Tanker sentiment seems to have hit rock bottom as tanker rates haven’t picked up yet. Current valuations provide an opportunity to increase exposure. It’s a risky move, but I believe there’s still potential for the seasonal uptick we’re accustomed to seeing or even a broader recovery in the first half of next year.

Positions for December 2024

- BIL (3x)

- DAC

- GNK

- HAFNI

- INSW

- NVGS

- OET

- TRMD

- ZIM

Closed positions

GLNG

GLNG has been one of the standout performers this year. With the stock at a level where further upside seems limited, I’ve decided to close the position. The proceeds will be reinvested into our more “downbeat” positions.

Portfolio Performance Tracking

This website contains no investment advice and is purely for informational and educational purpose. Do your own research! For more information please also check the model portfolio page.