It has been a few months since the last update, partly for personal reasons and partly because there was simply no need to make any changes to the portfolio.

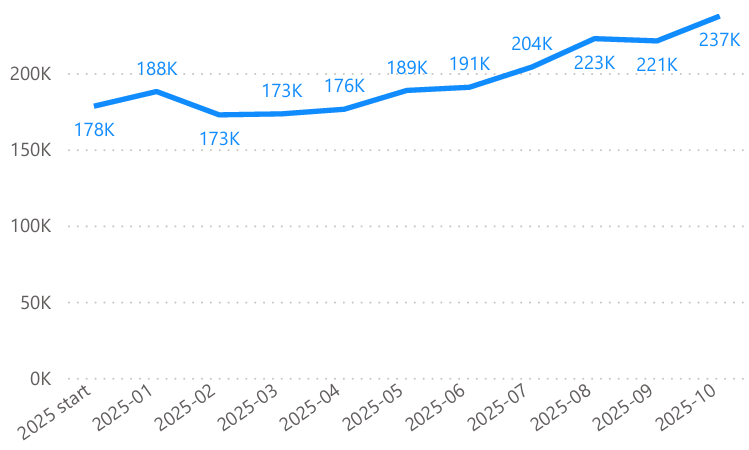

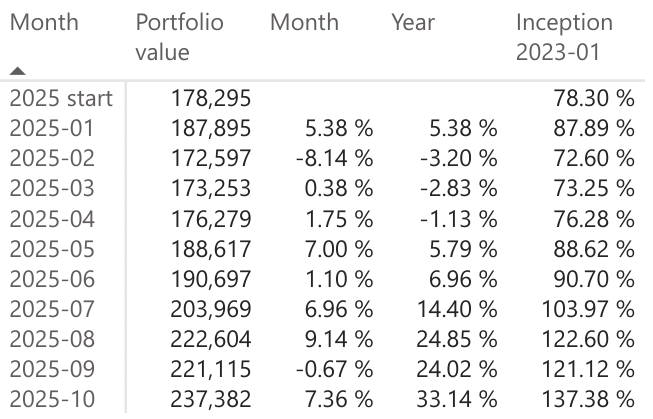

August was another strong month with a gain of 9.14%. September saw a small pullback of 0.67%, followed by a solid recovery in October with a 7.36% increase. Altogether this brings the year-to-date performance to 33.14% and total returns since inception in January 2023 to 137.38%.

The tanker thesis is finally starting to play out again, and valuations in the sector still look very attractive. I am keeping the portfolio unchanged for now, as the current picks continue to perform well and we are only midway through November.

Positions for November 2025

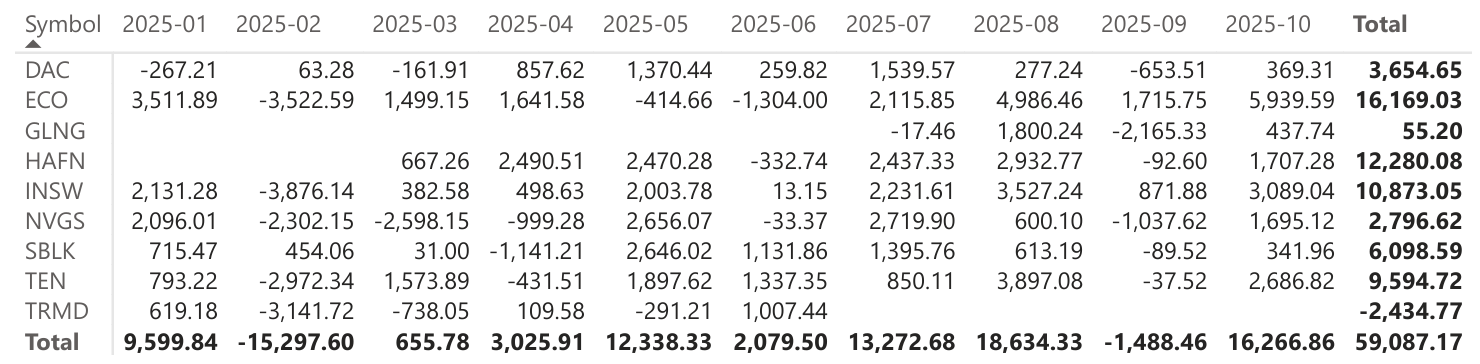

- DAC

- ECO

- GLNG

- HAFN

- INSW

- NVGS

- SBLK

- TEN

Portfolio Performance Tracking