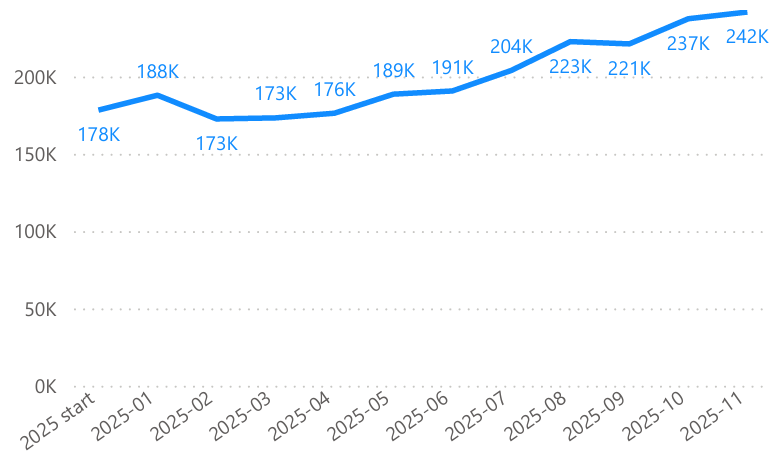

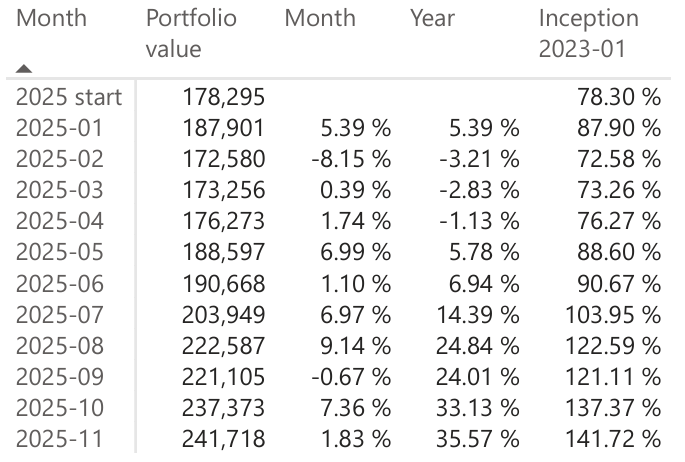

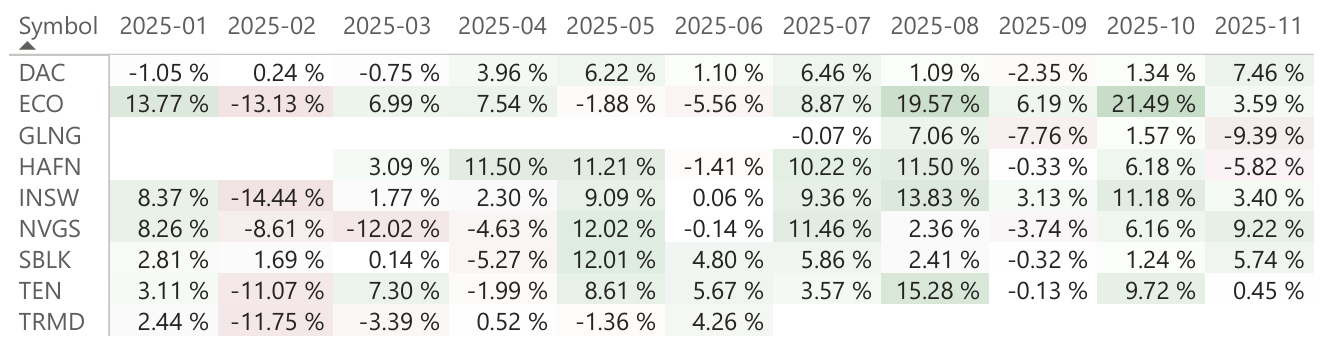

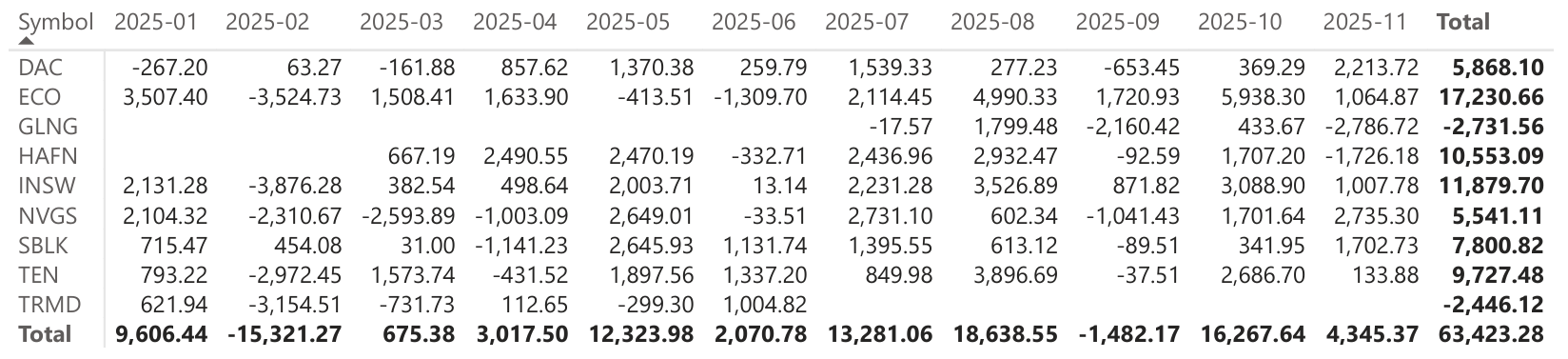

November was a steady month with a gain of 1.83%. Most positions moved in line with expectations, with only HAFN and GLNG showing weaker performance. Despite that, the overall trend remains positive and the portfolio continues to hold up well. This brings the year to date performance to 35.57% and total returns since inception in January 2023 to 141.72%.

I am considering a few position changes, but with December being the final month of the year I want to keep trading activity low. The current allocation is still solid and it makes more sense to carry these positions into January rather than reshuffle anything now.

Shipping continues to offer attractive setups compared to the broader market. US valuations and especially the large tech names leave little margin for error, while our sector still trades on reasonable fundamentals. I remain optimistic that we can continue to outperform the general indices.

Positions for December 2025

- DAC

- ECO

- GLNG

- HAFN

- INSW

- NVGS

- SBLK

- TEN

Portfolio Performance Tracking