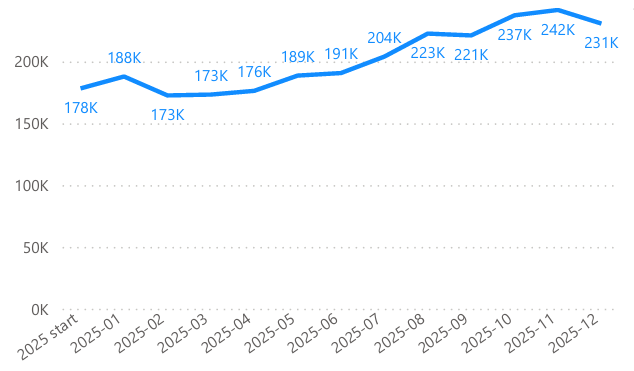

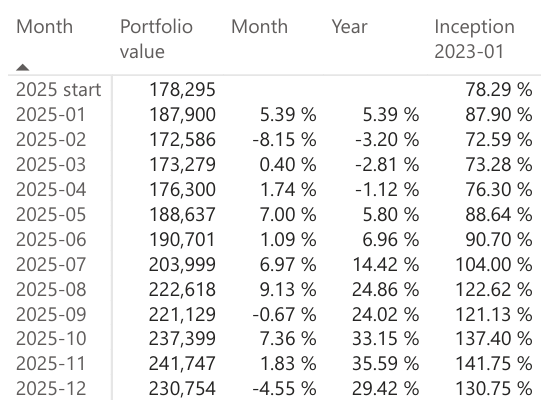

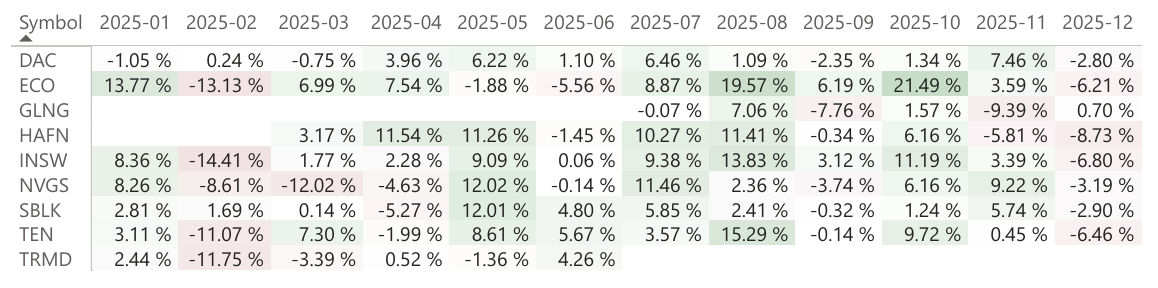

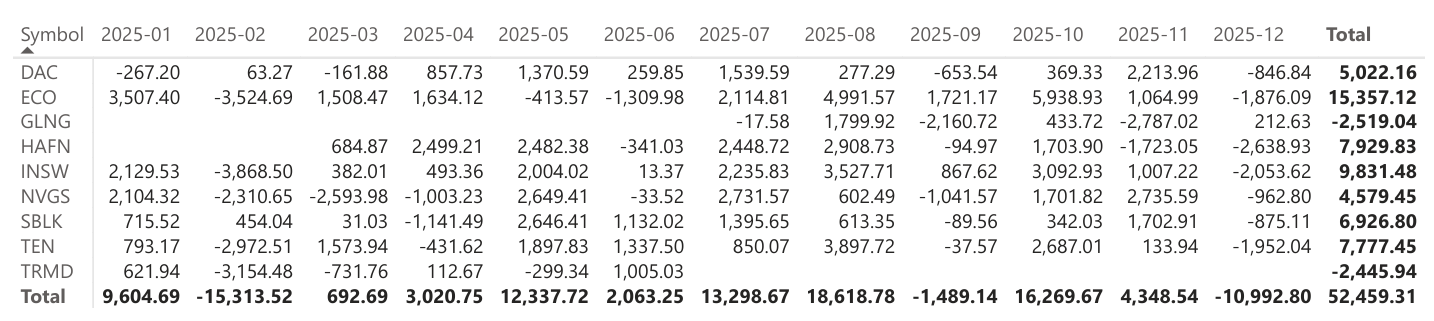

December was a tough month for the portfolio, down -4.55%. Shipping stocks in general ended the year on a weak note, and that showed up in several holdings. It wasn’t a great month, but the bigger picture still looks fine.

For the year, the portfolio finished with a YTD gain of 29.42%, which is a good result. We again beat both the S&P 500 and the Russell 2000. Since starting in January 2023, the portfolio is up 130.75%, which helps put this recent drop in context.

We are closing two positions this month: HAFN and INSW. There is nothing fundamentally wrong with either company. Both are well run, but I see better opportunities elsewhere.

The proceeds are being reallocated into two new positions: CMBT and SFL. At current levels, both offer what I see as a more attractive risk-reward profile.

Shipping had a disappointing end to the year, but the overall thesis has not changed. Valuations in the broader US market remain demanding, particularly in large tech, where expectations leave very little room for error. In contrast, many shipping names are still priced on conservative assumptions and continue to generate meaningful cash flows.

Entering 2026, I remain cautiously optimistic. Volatility is part of the game in this sector, and months like December are unavoidable. As long as fundamentals stay intact, I am comfortable with these swings and continue to believe that our approach can outperform the broader indices.

Positions for January 2026

- CMBT

- DAC

- ECO

- GLNG

- NVGS

- SBLK

- SFL

- TEN

Portfolio Performance Tracking